Modeling My Anti-Fragile Life

Often times, a bar or bat mitzvah is identified as the inflection point of a young Jewish person’s life. It’s described to the youth as the religious moment where you go from being a kid to Full Jewish Adulthood. The flip switches as soon as you walk off the Bima from reading your Torah portion. Given that I never really connected with the spirituality of religion, but certainly did connect with the ideas and laws of Judaism, my perspective on my Bar Mitzvah is surely different from many others. That was my thought until I saw A Serious Man, the greatest parable of American Judaism ever made.

I’ll go longform on the value of my Bar Mitzvah one day but for now the important thing to know is a decision that I had to make: party or a trip to Italy. The mythos of a Bar Mitzvah party was staggering and I felt I needed to partake, therefore Italy got pushed off.

Fast forward to the end of college. At the urging of my father, who never traveled and regretted it, I started putting funds away for a Europe trip. What would that entail? I had no idea as I’d never planned a trip before. I ballparked that I needed $4,000 to pay for everything, calculated the amount I needed to save each week, and put it into action. Not only did I guarantee myself the funding for my trip but it also allowed me to get as creative as possible in planning.

The result of six months of planning, research, route optimization, restaurant identification, historical artifacts etc., was five weeks in Europe. The Italy trip that I had pushed off at the age of 13 was my #1 priority. Given the extent of my financial planning, I went as big as possible. I flew into Rome, took the train to Naples, then Florence and Venice. Flew from Venice to Munich, Prague, and Amsterdam. Took the train from Amsterdam to Paris, drove to Normandy, flew to Barcelona, Sevilla, and Madrid. It was the best decision of my entire life bar none. I think about my trip every single day. I relish my memory of it so much, that I built a spreadsheet of every meal I ate. A year after the trip, purely off of memory (and some pictures).

Arguably the most important thing to happen was when I got home from my trip. I don’t regret a single penny I spent. I got back, looked at my credit card bills and realized I had no cash to my name. As a matter of fact, my net worth was -$300 for a period of days until I got some PTO for Juneteenth that I wasn’t expecting (hey, anti-fragility!).

As soon as I got back, I realized that I needed a way to manage my finances. I needed a spreadsheet that could track how much I make, how much I spend, and allow me to dictate what I spend on. It took a month of processing what I wanted it to look like in my head before I could build it, but it finally clicked.

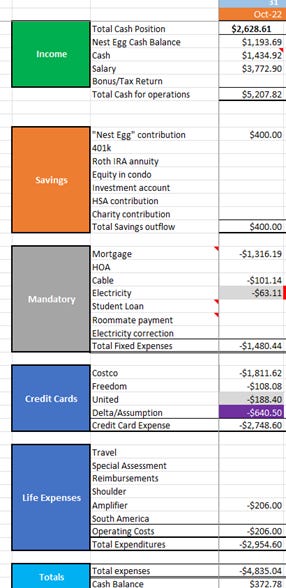

I decided on a philosophy that blended the attributes of a cash flow statement and an income statement. My income and other big cash events like bonuses or tax returns were my revenue. I had a mortgage to manage and “fixed costs” like electricity, cable, and my student loan. That left me with the ability to model my variable costs, or what I call my life expenses. I give myself a blank canvas each month. Spend within the number that I model for, and it doesn’t matter what I spend on. Personally, that level of optionality keeps me flexible and allows me to make spontaneous decisions that some might consider “bad”. I call them human.

My spreadsheet did a good enough job of communicating my future financial picture that I could make decisions like taking out an Abt card and buying my speaker set up. I spent 100% more than I was planning on. Again, one of the best decisions I’ve ever made.

The final piece of the spreadsheet was what made it a cash flow statement. I needed to ensure the answer was yes to, “Do I have enough cash to survive?” My formula is revenue-total expenditures = net cash balance, where “revenue” is the balance of my bank accounts + paychecks for the month+big cash items. Net cash balance gets brought to the top for the next month and I repeat the same process. Here’s an example from October 2022.

The purple $640 is the best example of why this spreadsheet gives me so much optionality. What was the expense? A plane ticket for work on my own card. The trip ended up getting cancelled and I couldn’t get it reimbursed because I never went on the trip. I really needed that cash! It worked out fine because less than a year later I used my Delta credit to go to London for dirt cheap. Using October 2022 also really highlights how I keep evolving this. Having line items for my big bulk travel spending, including the South America line, isolates the fun of going on a trip. “I’m going to spend a LOT of money and I’ve earned it.”

I think this system works very well for me. I’ve explained it to plenty of people who don’t have a budgeting system and they like my ideas. So far it hasn’t failed me. The only way it can fail me is if I lie to myself about my own spending. It’s not only a self-guided budget but it’s also the best accountability measure to what I do with my money.

Anti-fragility dictates growing from chaos or uncertainty. Given that I sacrificed not going to Italy at 13, I got 5 weeks in Europe, a life financial management philosophy, and a trip to London from it. Pretty solid trade off!